Mexico Sourcing Guide & Key Manufacturing Facts: 2025 Edition

Is Mexico a viable Diversification option for you?

Welcome to the Mexico Country Guide

Whether you're exploring alternatives to China or scaling your Mexico operations, this guide brings you practical data, sourcing insights, and on-the-ground context to help you move smart.

Want to go deeper? Create a profile to connect with others already sourcing from Mexico — as well as experts based in-country who can help you move faster with fewer blind spots.

Mexico Country Guide: Overview

- ➤ Mexico surpassed China as the United States’ largest trading partner, capturing 15.4% of U.S. imports compared to China’s 13.9% in 2023.

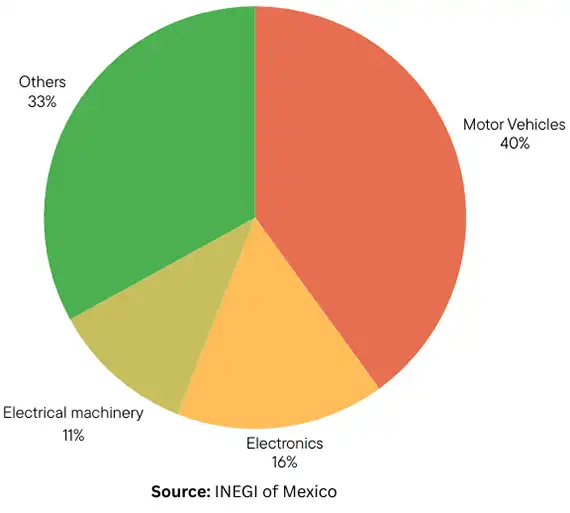

- ➤ Mexico’s manufacturing base is dominated by Motor Vehicles, Electronics, Electrical machinery.

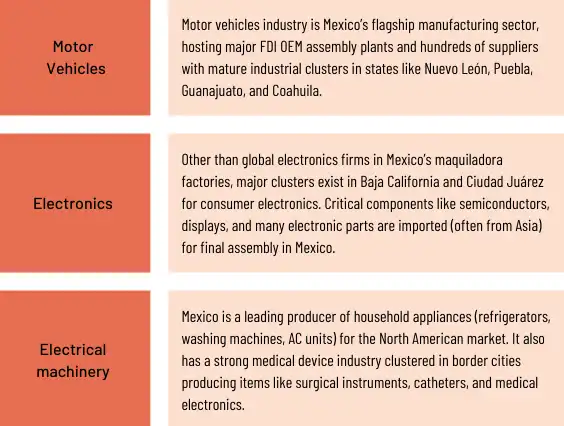

- ➤ As the 5th largest motor vehicle producer globally, Mexico’s industrial clusters are highly mature.

- ➤ Electronics and electrical device sector is resonably developed with inputs imported from Asia.

Curious how to make Mexico work for your business?

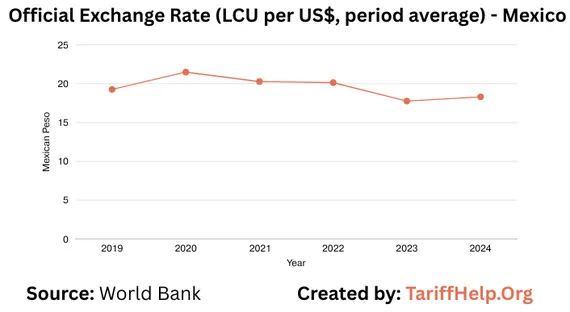

USD - Mexican Peso Exchange Trend

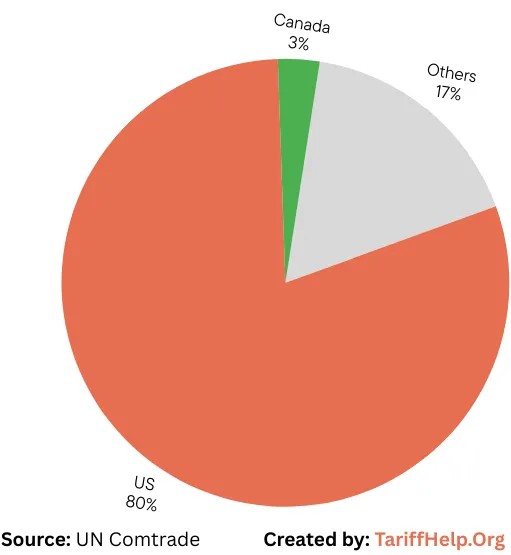

Markets of Mexico's Export

Markets of Mexico's Export FY 2023-2024

Top Tips for Sourcing from Mexico

- ➤ Motor Vehicles, Electronics, Electrical machinery are Mexico's strengths.

- ➤ Mexico's electronics and electrical machinery are import reliant, Asian countries might be a better option if you want faster customization.

- ➤ Mexico has Sizable industrial clusters for each industry, so aiming the right place for your products will save your time in sourcing.

- ➤ Work with local agents, inspectors, or sourcing pros who know the regional nuances and factory tiers.

Want deeper insight or local support? Creating a profile connects you with real Mexico sourcing pros — people on the ground who can help you avoid common blind spots and move with more confidence.

Export of Mexico by Sector

Primary Export of Mexico in FY 2023-2024

Key Manufacturing Export

Primary Export industries

Sourcing Chances & Challenges

- ➤ Geographic Proximity: Mexico’s location next to the U.S. offers unparalleled supply chain speed and cost: most of Mexico’s exports to the U.S. move by land which typically means 1-5 day transit times versus 3-5 weeks by ocean from China, shipping costs from Mexico to the U.S. are ~82% lower than from China.

➤ Better cultural and business alignment than working with suppliers in Asia.

➤ Challenges: border congestion, Inefficient customs procedures, Cargo theft and security risks in transit, production delay thanks to crime and utilities shortage.

➤ Supply Constraint: Many specialized components or materials may be limited or non-existent in Mexico.

If you're navigating these sourcing challenges, you're not alone. Creating a profile gives you access to deeper insight from experts on the ground — and lets you connect in real time with others facing similar hurdles in our growing community.

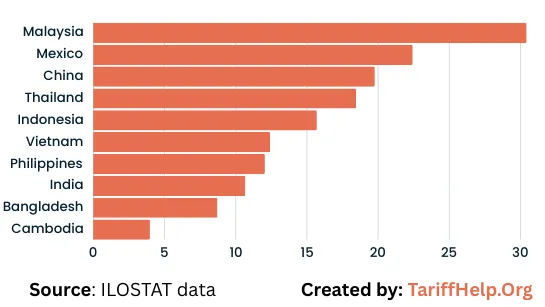

Labor Productivity in Mexico

GDP/hour worked, 2021 international $ at Purchasing Power Parity in 2025

Why Mexico Still Stands Out

As China’s costs climb and global trade tensions linger, Mexico is emerging as a smart alternative. With decades of industrial know-how, built-in sector strengths, and a youthful, tech-trainable workforce, Mexico offers more than just cheaper labor — it offers capability. Its deep ties to the U.S. market, fast logistics, and trade-friendly framework make it a launchpad for what’s next in global sourcing.

Got a sourcing question or stuck on strategy? Create your profile and get connected with people who can help — including those already sourcing from Mexico.