Vietnam Sourcing Guide & Key Manufacturing Facts: 2025 Edition

Is Vietnam a viable Diversification option for you?

Welcome to the Vietnam Country Guide

Whether you're exploring alternatives to China or scaling your Vietnam operations, this guide brings you practical data, sourcing insights, and on-the-ground context to help you move smart.

Want to go deeper? Create a profile to connect with others already sourcing from Vietnam — as well as experts based in-country who can help you move faster with fewer blind spots.

Vietnam Country Guide: Overview

- ➤ Vietnam is now a top manufacturing hub in Asia and a leading China alternative for U.S. importers across key categories.

- ➤ The U.S. is the largest importer of Vietnam’s manufactured goods — especially textiles, furniture, and electronics.

- ➤ Shifting tariffs and strategic realignments have accelerated Vietnam’s rise, though many suppliers remain Chinese-owned — creating new risks amid political tension.

- ➤ Vietnam’s supply chain strengths span both traditional sectors and high-growth verticals — but complexity remains. See Navigating Vietnam below for practical challenges and solutions.

Curious how to make Vietnam work for your business?

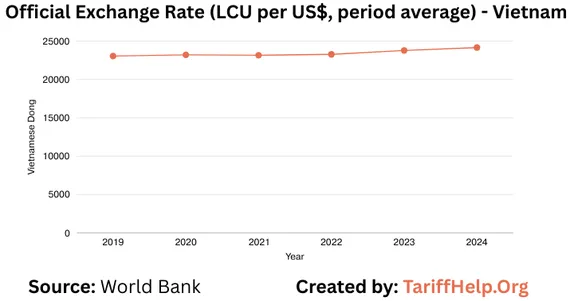

USD - Vietnamese Dong Exchange Trend

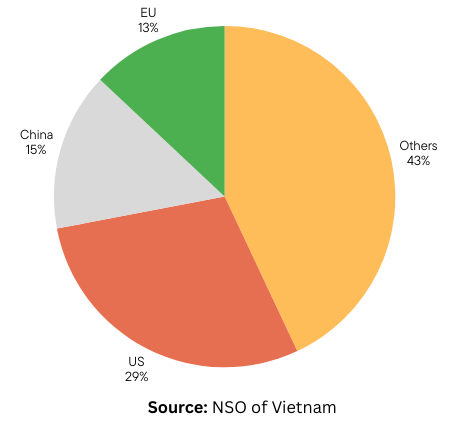

Destination of Vietnam Exports

Primary Market of Vietnam Export 2024

Top Tips for Sourcing from Vietnam

- ➤ Focus on Vietnam’s traditional strengths — garment, textile, Footware.

- ➤ Don’t assume factory ownership equals local expertise — many large suppliers are Chinese-owned and operate differently.

- ➤ Vet factories for export-readiness — even mid-sized suppliers may lack QC systems or scale for global orders.

- ➤ Work with local agents, inspectors, or sourcing pros who know the regional nuances and factory tiers.

Want deeper insight or local support? Creating a profile connects you with real Vietnam sourcing pros — people on the ground who can help you avoid common blind spots and move with more confidence.

Vietnam Opportunities & Challenges at a Glance

Vietnam blends deep manufacturing tradition with emerging high-tech momentum — but success depends on knowing where (and how) to engage the right suppliers. See earlier overview notes for more context.

- ➤ Strong bases in garment, textiles, furniture.

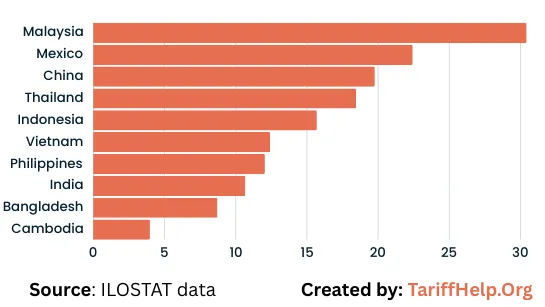

- ➤ Low labor costs (~$3/hour) and major investments in industrial zones and export capacity

- ➤ Domestic supply chain is still maturing — many components still imported, especially from China

- ➤ Gaps in QC, factory scale, and communication can slow or derail new partnerships

- ➤ Works best when paired with local agents or on-the-ground insight — especially in non-FDI sectors

Key Export Manufacturing Industries

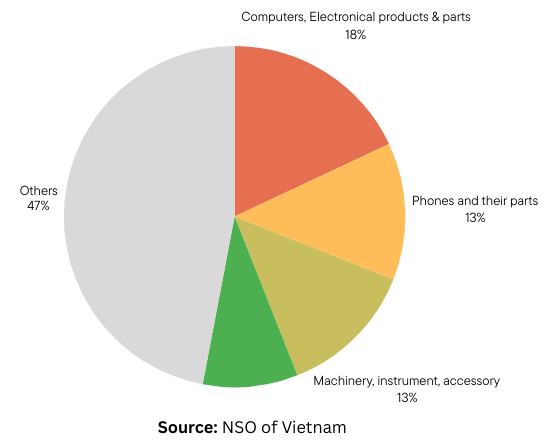

Primary Export industries in 2024

Export of Vietnam by Sector

Primary Export of Vietnam in 2024

Note: 98% of the Phone, electronics, computers exports are by FDI such as Apple, Samsung, LG

Key Export Sectors at a Glance

Vietnam’s top sectors shape what’s possible in sourcing — from supplier access to timelines and product consistency.

- ➤ Apparel, wood, and furniture offer strong local networks and high flexibility

- ➤ Electronics exports are booming — but driven by FDI and harder to access

- ➤ Factory models vary: domestic firms in traditional goods, JVs in tech sectors

- ➤ Export readiness often aligns with sector maturity — not company size

Skilled Labor & Sourcing Challenges

- ➤ Skill gaps remain in machining, QA, and production engineering.

- ➤ Factory quality, scale, and communication vary widely across regions.

- ➤ Delays still happen — especially at smaller ports or during peak seasons.

- ➤ These are solvable with local support — agents, inspectors, and prep make all the difference.

If you're navigating these sourcing challenges, you're not alone. Creating a profile gives you access to deeper insight from experts on the ground — and lets you connect in real time with others facing similar hurdles in our growing community.

Labor Productivity in Vietnam

GDP/hour worked, 2017 international $ at Purchasing Power Parity

Why Vietnam Still Stands Out

With rising costs in China and growing trade uncertainty, Vietnam has become the go-to choice for importers seeking reliable, cost-effective production. From textiles to electronics, it offers deep manufacturing experience, sector-specific advantages, and a young, scalable workforce. Add to that its export infrastructure and trade-friendly policies — and you’ve got a sourcing destination built for what’s next.

Got a sourcing question or stuck on strategy? Create your profile and get connected with people who can help — including those already sourcing from Vietnam.